According to the latest digital payments report from NPCI, India’s e-commerce sector is exploding, driven by the massive adoption of UPI. If you are starting an online store, choosing the right technology partner is critical.

Your payment gateway is the final step between a customer wanting your product and actually buying it. If it fails, you lose money.

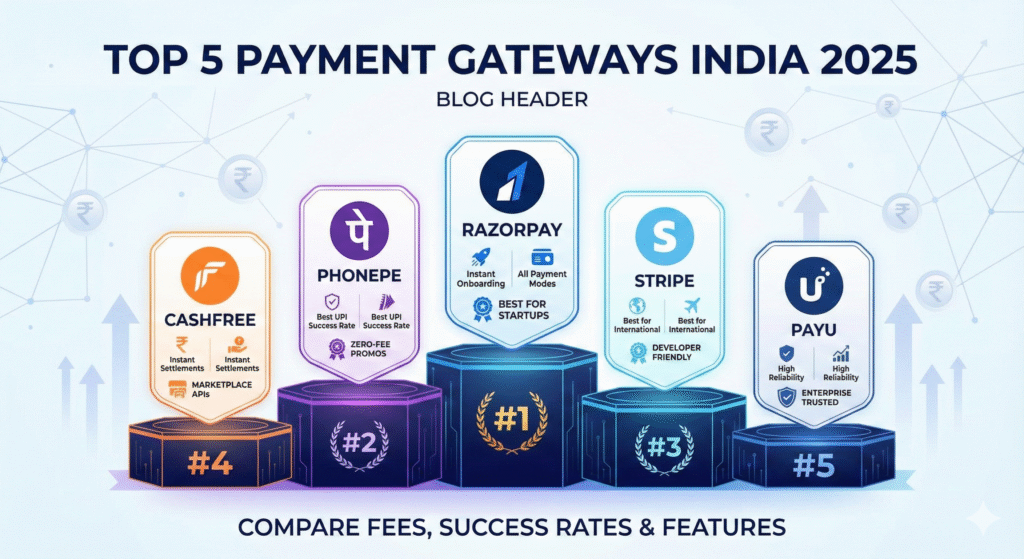

But with so many options, which is the best payment gateway in India for your specific business needs? In this post, we cut through the marketing noise and compare the top 5 contenders based on transaction fees, settlement speed, and success rates.

1. Key Factors to Consider Before Choosing

Before we list the top providers, you need to understand what you’re looking for:

- Transaction Fees (TDR): A percentage of each sale the gateway keeps. For example, 2% on a ₹1,000 sale is ₹20.

- Success Rate: How often transactions fail due to technical issues. A 5% failure rate means losing 5 out of every 100 customers.

- Settlement Time: How fast the money hits your bank account (usually T+1 or T+2 days).

- Security: Ensure they have PCI DSS compliance to protect customer data.

2. Top 5 Payment Gateways in India

#1 Razorpay

Razorpay is currently the market leader for startups and small businesses in India.

- Pros: Extremely easy onboarding (often instant), supports every payment mode imaginable (UPI, Credit Card, EMI, Wallets), and has excellent developer documentation.

- Cons: Customer support can sometimes be slow for smaller accounts.

- Best For: Most startups, SaaS businesses, and e-commerce stores.

#2 PhonePe Payment Gateway

A newer but powerful entrant, PhonePe is leveraging its massive consumer user base.

- Pros: Industry-leading success rates for UPI transactions. They often run zero-fee promotional periods for new merchants.

- Cons: Fewer international payment options compared to Razorpay or Stripe.

- Best For: Businesses primarily targeting Indian customers via UPI.

#3 Stripe India

Stripe is the global standard for developer-friendly payment processing.

- Pros: Best-in-class user interface, robust APIs for custom integrations, and excellent for handling international currencies.

- Cons: Onboarding can be stricter, and fees for international cards are higher than local competitors.

- Best For: Businesses with a significant international customer base or complex subscription models.

#4 Cashfree Payments

Cashfree is a strong competitor to Razorpay, known for its payout features.

- Pros: Famous for its “Instant Settlements” feature (for an extra fee) and robust banking APIs for marketplaces that need to split payments to vendors.

- Cons: The dashboard UI is slightly less intuitive than Razorpay’s.

- Best For: Marketplaces and businesses that need instant access to their funds.

#5 PayU

One of the oldest and most established players in the Indian market.

- Pros: High reliability and trusted by large enterprises.

- Cons: Onboarding process is more traditional and paperwork-heavy compared to the newer players.

- Best For: Large, established enterprises with high transaction volumes.

Conclusion

There is no single “best payment gateway in India” for everyone.

If you need the fastest setup and broadest feature set, Razorpay is the safe bet. If your focus is pure UPI speed in India, PhonePe is excellent. If you are building a global SaaS product, Stripe is unmatched.

Need help integrating a payment gateway into your e-commerce store? At Adeluxe.in, we build secure, high-converting online stores. Contact us today for a seamless e-commerce setup.